Services

Asset Services

Relentlessly optimising assets and portfolios for our clients, regardless of complexity

Property owners across India face mounting pressure to enhance asset value while managing operational complexities and evolving tenant expectations. Our asset services professionals deliver integrated solutions that transform underperforming properties into high-performing investments, ensuring sustainable returns in India’s dynamic commercial real estate landscape.

Combining deep market insights with proven methodologies, we design growth-focused strategies that address both immediate operational needs and long-term investment goals. From navigating regulatory requirements to optimising efficiency and enhancing tenant experiences, we help property owners drive performance and create lasting value.

Ready to unlock your property's potential? Contact our team to discuss your asset management strategy.

What Sets Us Apart

Relentless focus on detail

Precision in property management delivers exceptional long-term outcomes. Our teams concentrate on critical operational elements to enhance performance, reduce costs, and mitigate risks across all asset classes. In India's complex regulatory landscape, this detailed approach ensures compliance and operational excellence.

Tailored programs, better experiences

Every property presents unique challenges. We design customised management programmes that create distinctive tenant experiences by combining advanced technology with meaningful human connections. Our localised approach considers the cultural and market dynamics specific to the local commercial real estate.

Timely, accurate financial reporting

Our client accounting team delivers precise, real-time financial reporting that enables confident decision-making. Our frameworks comply with local accounting standards, providing the transparency and accuracy required for strategic planning.

Seamless transitions, consistent support

Our dedicated teams ensure unmatched compliance, quality control, and service continuity from day one. We manage the complexities of property transitions to ensure smooth handovers, minimise disruption, and accelerate value creation.

Experiences that drive value

By blending cultural understanding with innovative technology, we create memorable tenant experiences that improve retention and drive sustained asset value. Our approach supports productivity and wellbeing across the local diverse commercial markets.

Services

Our Asset Services

Property Management

We design and deliver growth-focused property management solutions that increase asset value whilst ensuring tenant satisfaction. Our comprehensive approach encompasses lease administration, tenant relations, maintenance coordination, and strategic asset positioning to maximise rental income and occupancy rates.

Cost Control and Risk Mitigation

Our asset services experts help reduce operating costs, improve operational efficiency, and leverage technology to drive overall value creation. We implement robust risk management frameworks that protect against operational, financial, and regulatory risks whilst optimising resource allocation and vendor management.

Investment-focused Insights

We gather intelligence from our global network to provide accurate market insights that support sound investment decisions. Our research capabilities combine local market expertise with international best practices, enabling property owners to identify opportunities, assess risks, and implement strategies that enhance portfolio performance.

Specialisation

Industry Expertise

Office

The office sector is evolving, necessitating adaptive asset management. We provide specialised services addressing hybrid models, sustainability, and tenant experience, from flexible workspaces to advanced technology solutions. Our expertise ensures properties remain competitive, enhancing tenant satisfaction and maximizing rental income.

Learn more about our office services

Industrial

Benefiting from e-commerce growth and manufacturing expansion, India’s industrial sector requires robust asset management. We deliver specialised services to manage operational complexities, from warehouse facilities to manufacturing plants. Our focus is on optimizing workflows, managing lease structures, and ensuring operational efficiency and regulatory compliance.

Learn more about our industrial services

Retail

The retail landscape demands dynamic asset management amidst evolving consumer preferences. We provide comprehensive services for retail properties, from neighbourhood centres to large destinations. Our expertise optimizes tenant mix, enhances customer experience, and implements operational strategies to drive footfall and sales performance.

Learn more about our retail services

Research

Research • Workplace

India Office Market Report - Q3 2025

Insights • Sustainability / ESG

Indian Real Estate 2030: Technology, Sustainability, & Growth

Insights • Workplace

Insights • Investment / Capital Markets

Mumbai’s Office-SEZs get a new lease of life as leasing volume surge

Research • Workplace

REWORKING the Office Asia Pacific

Research • Workplace

Rethinking the office sector in Asia Pacific

Insights • Investment / Capital Markets

Premier office buildings in BKC filling-up fast. What should occupiers look for as an alternative?

Insights • Investment / Capital Markets

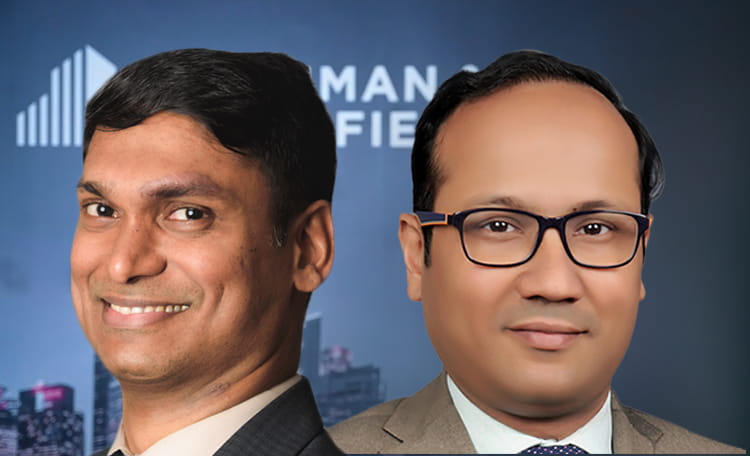

Saurabh Shatdal & Somy Thomas: High Yields and Strong Growth across India’s Real Estate Markets

Insights • Investment / Capital Markets

India Office Market Report Q1 2020

Insights • Investment / Capital Markets

DCPR 2034 Unleashing Mumbai's Economic Potential